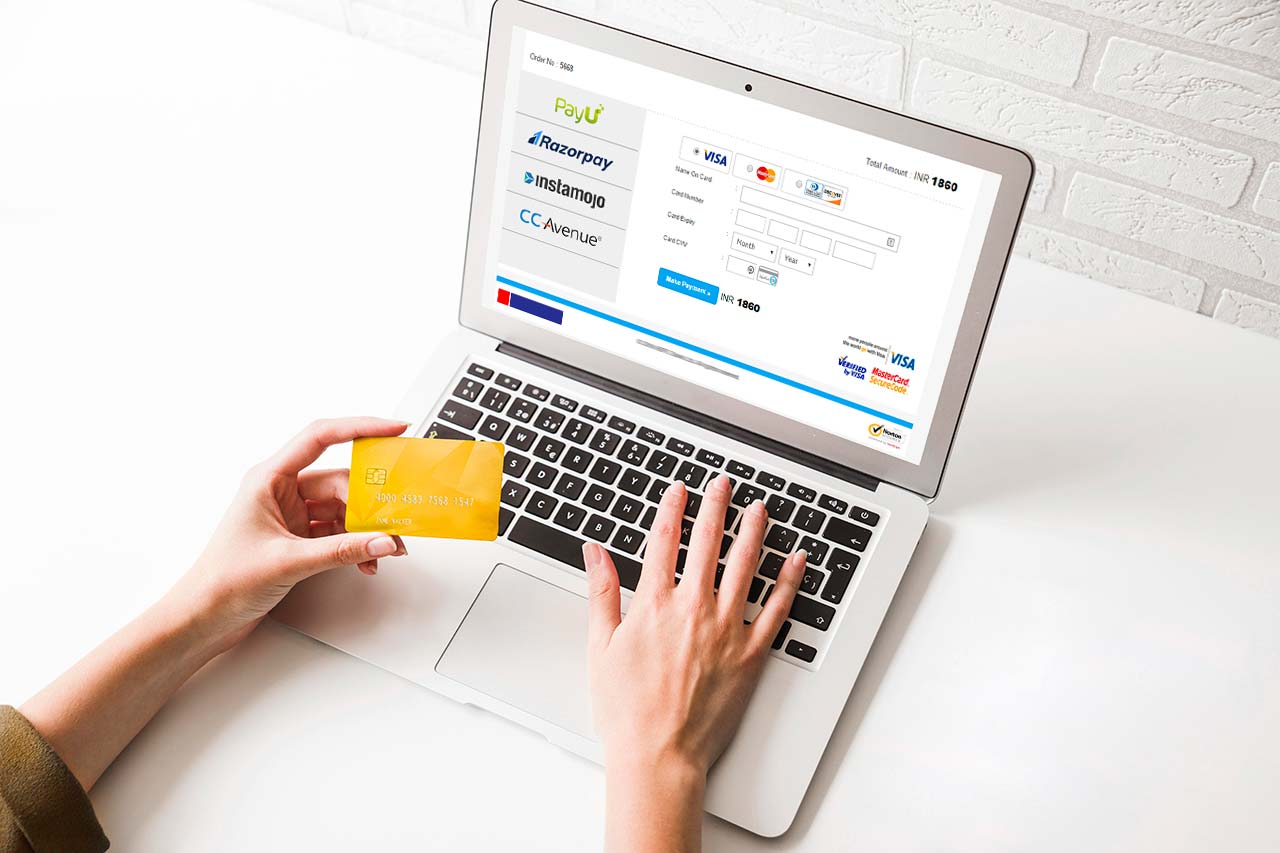

PayU vs. Razorpay vs. Instamojo vs. CCAvenue Payment Gateways

Research by Google indicates that 47% of global purchases are completed online.

Research by Google indicates that 47% of global purchases are completed online.

What’s more, by the end of 2020, global eCommerce sales are expected to reach $4.2 trillion and amount to approximately 16% of total retail sales.

As customers increasingly switch to online purchases, businesses are also expanding to the digital business space. With that in mind, it’s essential for online businesses to leverage specific business web platforms such as payment gateways to facilitate easy and secure transactions between companies and their customers.

However, technology advances have brought about a myriad of options including PayU, Razorpay, Instamojo, and CCAvenue and more, when it comes to payment gateways.

Whether your business has been in existence for some time now or is a startup, the question of which payment gateway to adopting for your business often hits home.

In this article, we describe PayU, Razorpay, Instamojo and CCAvenue payment gateways, highlighting their key features and differences to help you answer the question: which payment gateway is best suited to my business model?

Brief Overview Of PayU, Razorpay, Instamojo and CCAvenue

Before we can delve deeper and compare PayU, Razorpay, Instamojo, and CCAvenue, it’s safe to say we need a foundation on what exactly these Payment Gateways are, what they do, and their workflow.

Let’s get started!

PayU Payment Gateway

PayU is a payment solution provider that enables online businesses to securely process and accept payments through various payment methods that can be integrated with web and mobile applications such as Credit Card, Debit Card, Net Banking, etc.

PayU is a payment solution provider that enables online businesses to securely process and accept payments through various payment methods that can be integrated with web and mobile applications such as Credit Card, Debit Card, Net Banking, etc.

The gateway caters to both registered or unregistered businesses and can be used by individuals as an independent digital payment tool. The platform also offers an online dashboard where companies can view and monitor payment information, reports, and other essential data.

Razorpay Payment Gateway

Razorpay is a full-sized payment solution that allows businesses to accept, process, and disburse payments within its product suite.

Razorpay is a full-sized payment solution that allows businesses to accept, process, and disburse payments within its product suite.

The platform provides your business with access to payments via many modes such as credit card, debit card, Netbanking, UPI, and popular wallets. Companies are also able to monitor real-time data performance and insights to make informed business decisions.

Instamojo Payment Gateway

Instamojo is a full-stack transactional payment platform that allows businesses to collect payments through net banking, e-wallets, credit, and debit cards. It also boasts payment links that are shareable via various online platforms.

Instamojo is a full-stack transactional payment platform that allows businesses to collect payments through net banking, e-wallets, credit, and debit cards. It also boasts payment links that are shareable via various online platforms.

Apart from payments, Instamojo provides a suite of services and products to help sellers create online stores, uncover insights on their store behaviour, and use the information to empower their business.

CCAvenue Payment Gateway

Lastly, CCAvenue is a payment gateway service provider for businesses that offers simple, secure, and validated Internet payments via a complete range of online payment solutions such as Credit or Debit Cards, Net Banking, Digital Wallets, Mobile Payments, etc. The service enables online businesses to sell their products and services online while accepting payments in real-time.

Lastly, CCAvenue is a payment gateway service provider for businesses that offers simple, secure, and validated Internet payments via a complete range of online payment solutions such as Credit or Debit Cards, Net Banking, Digital Wallets, Mobile Payments, etc. The service enables online businesses to sell their products and services online while accepting payments in real-time.

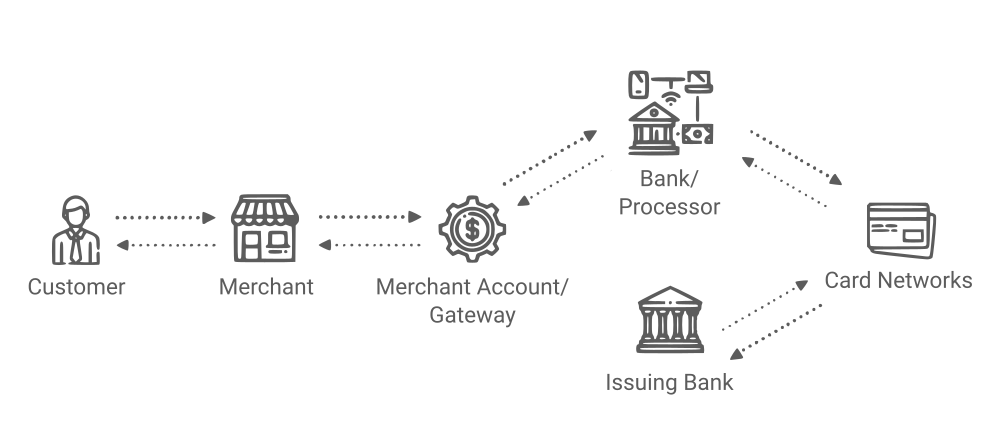

How Payment Gateways Work

The underlying workflow for payment gateways is mostly similar. Once a buyer selects the type of payment method to make a transaction, the following happens.

The underlying workflow for payment gateways is mostly similar. Once a buyer selects the type of payment method to make a transaction, the following happens.

- Encryption between the buyer’s browser and seller’s site’s server. The seller’s site will also encode data exchanged between the two endpoints.

- The payment processor requests authorization from the seller’s bank account/financial institution. On approval, the buyer’s bank successfully moves ahead with the transaction.

- The buyer authorizes the payment, enters the necessary details confirming their identity, which then allows the bank to credit payment to the merchant’s account.

A Detailed Comparison Between PayU, Razorpay, Instamojo, and CCAvenue

Now that we have a background on PayU, Razorpay, Instamojo, and CCAvenue face-off, we’ll compare the payment gateways in a more detailed fashion. Specifically, we’ll look at some crucial factors you should consider before choosing and settling on a payment gateway option for your business.

1. Pricing — Transaction Cost and Fees

Whichever payment gateway you choose, you can’t afford to overlook pricing. Here is what you need to know about pricing for each platform:

PayU

PayU’s pricing model is simple. For PayUMoney merchants, you have no monthly fees or annual maintenance fees. Instead, you pay when and if you use the service as follows:

- A flat 2% + GST per transaction for Indian Credit and Debit Cards, Net banking, Indian Wallets, and UPI.

- For international transactions, American Express, Diners Cards, and EMI payment options, etc. you’re charged a 3% + GST fee. Also included is a setup fee paid along with Annual Maintenance Charges and a service fee of 3% + ₹6 per transaction.

Razorpay

Razorpay follows a similar approach in its pricing scheme, as shown below:

- A 2% fee (GST applicable) per transaction for Indian Consumer Credit Cards, Debit Cards, Net Banking, UPI, and Wallets.

- A 3% fee (GST applicable) per transaction for Amex or Diners Cards, International Cards, and EMIs.

Razorpay offers no setup or maintenance fee. Impressively, it includes an Enterprise plan designed for large volumes where businesses can negotiate custom pricing.

Instamojo

Instamojo offers zero setup or maintenance fees for free stores with the only applicable when making a transaction:

- A flat 2% + Rs. 3 (exclusive GST) per transaction for Indian Debit/Credit Cards, Net banking, UPI, EMI, and Indian Wallets.

- A 3% + Rs. 3 International cards, AMEX cards etc.

Notably, a 5% + Rs 3 fee per transaction is charged for digital products and files, whereas a premium store charges Rs.7999/year at a 2% + Rs.3 fee per transaction.

CCAvenue

Last but not least, CCAvenue takes a different approach in its set up fee pricing. It includes two plans: A Startup Pro Plan with no charges and the Privilege Plan that charges Rs. 30,000.

Moreover, an Annual Software Upgradation charge of Rs 1200 applies to Startup accounts. Transaction fees are charged as follows:

- Domestic Credit & Debit cards on Visa, Mastercard, Maestro, 58+ Netbanking 10+ Prepaid Cards / Wallets and EMIs

- A fee @ 2% on Domestic Credit/Debit cards on Visa, Mastercard, Maestro

- 3.00% on Domestic Commercial Credit Cards

- 0.00% on UPI Payments and Rupay Debit Cards

- 4.00% on International MasterCard and Visa Credit / Debit Cards

- 4.99% on 27 Multi-currency options

- 0.20% – 0.50% + GST per day for CCAvenue Finance service

2. Chargebacks and Refunds

Depending on your payment gateway and mode of payment used, chargebacks and refunds take an unspecified time to be resolved.

Beyond that, the triad of PayU, Razorpay, Instamojo, and CCAvenue does not charge any processing fee for chargebacks or refunds. However, the transaction fee inclusive of applicable Good and Services Tax (GST) fees at the time of payment capture is irreversible back to your account.

3. Payment Methods, Multi-currency Support, and Availability

PayU supports various payment modes including Credit/Debit Card including Visa, MasterCard, Rupay, AMEX, Diners and International Cards, Net banking from top banks such as SBI, HDFC, AXIS, etc. E-Wallets support includes Paytm, JioMoney, Mobikwik, Airtel Money, and PayZapp. PayU also accepts payments in more than 100 foreign currencies with availability in over 17 countries.

Moving on, Razorpay supports over 100+ payment modes including Credit/ Debit Cards such as Mastercard, Rupay, Visa, AMEX, Diners, etc., Net Banking from over 50 banks, UPIs, Online Wallets, EMIs (Credit/Debit Cards & Cardless), PayLater and NEFT/RTGS payments. Moreover, it offers support for above 92 currencies, including USD, EUR, GBP, SGD, AED, with availability in 100 countries.

CCAvenue processes payments in 27 major currencies apart from the Indian Rupee. Its wide range of payment options includes credit and debit cards, over 35 Indian net banks, cash cards, and mobile payment options.

Currently, Instamojo does not support international payment, credit cards, and multi-currency support.

4. Website and Ecommerce Integration

PayU

PayU is easily integrated into most online e-commerce software and websites with comprehensive documentation, references, developer tools, and plugins. You only need a secure merchant account and your security key integrated into your online store to readily accept payments. PayU also supports popular eCommerce CMS Systems such as WordPress, Shopify WooCommerce, WHMCS, Prestashop, Opencart, Magento, CS-Cart, etc.

Razorpay

Razorpay boasts a simple integration and deployment process. Web and mobile app developers can integrate Razorpay Checkout by including a single code line on your website or a custom button. The integration process is quick and includes many features that require no upgrade from your end.

It’s integrative into either the Pre-built Standard Checkout, the customizable Custom Checkout, or the Hosted Checkout. Razorpay supports popular eCommerce CMS Systems such as WordPress, WooCommerce, WHMCS, Magento, Prestashop, Shopify, Arastta Opencart, CS-Cart, etc.

Instamojo

Instamojo can be easily integrated on any website with any tech stack. It has Simple Payment APIs with detailed documentation and SDKs for all major platforms. Along with responsive developer support, integrating Instamojo should be straightforward. Instamojo supports all popular eCommerce CMS systems plugins, including CS-Cart, Meteor JS, Drupal, WordPress, WHMCS, Magento 2.0, Magento, and Prestashop.

CCAvenue

CCAvenue web integration is pretty easy, given its fast and seamless integration APIs, a detailed integration kit, and well-defined internal processes. Developers should run it running in the shortest time possible. It supports eCommerce CMS systems plugins such as Buildabazaar, Cubecart, Interspire, Magento, Joomla, Magento Go, OsCommerce, NopCommerce, PrestaShop, ZenCart, etc.

5. Security

With the risk involved in handling sensitive data, it’s only natural for businesses and consumers to be highly concerned. Nonetheless, with PayU, Razorpay, Instamojo, and CCAvenue, you needn’t worry about security.

PayU is PCI-DSS compliant and uses a 128-bit SSL encryption for secure transactions. The company also boasts embedded security protocols that run deep encryption to protect the sensitive payment information and the transaction information from fraudulent attacks.

On the other hand, Razorpay is PCI-DSS and ISO: 27001 compliant. It uses the 128bit SSL/TLS certification for data encryption and tokenization to ensure that sensitive data is protected from fraudulent activities.

Instamojo is also PCI-DSS compliant and employs 128-bit AES encryption, Tamper-proof links, and performs Trusted merchants and background checks to ensure data security.

Not to be left behind, CCAvenue like the others features PCI-DSS 1.1 Standards of Compliance, VeriSign’s 128-bit SSL data encryption, and a Fraud & Risk Identification System & Knowledgebase (FRISK). FRISK assesses each transaction against a rich negative database for verification in over 150 variables like high-risk global IP address verification, keystroke seed recording, BIN number mapping, etc. Merchants can also run personalized transaction controls.

Besides payment gateway, a website requires its own SSL certificate that keeps customers’ data intact with strong encryption. It is recommended to have a digital certificate that covers main domain and subdomain if any. To secure subdomains and domain, there is a comodo PositiveSSL wildcard cert solution that also allows to add further subdomains in near future. A secured website is necessary when you deal with financial or login credentials.

6. Customer Support

PayU provides customer support via chat support. On the other hand, Razorpay customer support is available 24/7 via Chat Support and IVR.

Instamojo offers email and IVR support with the service closed over weekends. However, even on weekdays, your calls may go answered. CCAvenue claims 24x7x365 days of Voice, Chat, and email support, except for weekends. Their team is very responsive to queries.

7. Mobile App Support

In terms of mobile app support, Razorpay, Instamojo, and CCAvenue offer easy mobile app integration and are available on iOS and Android platforms.

8. User-Friendliness

PayU has a single dashboard where businesses can access their information. Its system also suggests the best and fastest payment method for customers. Furthermore, PayU is developer-friendly with a customizable user interface.

Razorpay boasts easy yet intuitive integration processes, unique customer-friendly features, functionalities, and a practical dashboard not to mention competitive pricing and diverse payment modes.

Instamojo is easy to use and features developer-friendly APIs integration services, a single dashboard to manage business data, and several business products.

CCAvenue also comes with a great dashboard, a responsive web design, and a feature that allows payments via social handles. Still, it has a ‘Retry System’ that enables users to retry failed transactions while indicating the reason for failure. It also offers multilingual support and varied payment modes.

Which Businesses Use PayU, Razorpay, Instamojo and CCAvenue?

When choosing between PayU, Razorpay, Instamojo, and CCAvenue for payment processing, it’s fair to look at businesses that have successfully integrated and used them.

Companies like Netflix, goibibo.com, Airbnb, CRED, redBus, book my show, and Dream11 use PayU.

Razorpay has a network of customers that includes Grofers, goibibo, book my show, Airtel, Zomato, IRCTC, and more.

Instamojo‘s customer portfolio includes Bikersoul, Camp Monk, InsightsIAS, Legalwiz.in, etc.

while CCAvenue has Mcdonalds, Freecharge IndiGo, Myntra.com, and many more.

Comparison Table for PayU, Razorpay, Instamojo, and CCAvenue

Here’s a table summary of PayU vs Razorpay vs Instamojo vs CCAvenue features

| Feature | PayU | Razorpay | Instamojo | CCAvenue |

| Setup Fee | Zero for PayU merchants | Zero | Zero | Zero for Startup Pro Plan, Rs. 30,000 for Privilege Plan |

| Recurring Fee | 2% + GST per transaction for Indian Credit and Debit Cards, Net banking, Indian Wallets, and UPI 3% + GST fee for international transaction, American Express, Diners Cards, and EMIs plus a setup fee paid along with Annual Maintenance Charges and a service fee of 3% + ₹6 per transaction |

2% fee (GST applicable) per transaction for Indian Consumer Credit Cards, Debit Cards, Net Banking available for 58 Banks, UPI, Wallets 3% fee (GST applicable) per transaction for Amex or Diners Cards, International Cards, EMIs |

2% + Rs. 3 (exclusive GST) per transaction for Indian Debit and Credit Cards, Net banking, UPI, and Indian Wallets A 3% + Rs. 3 International cards 5% + Rs 3 fee per transaction for free online stores Rs.7999/year at a 2% + Rs.3 fee per transaction for premium stores |

2% on Domestic Credit & Debit cards 3.00% on Domestic Commercial Credit Cards 0.00% on UPI Payments and Rupay Debit Cards 4.00% on International Cards 4.99% on 27 Multi-currency options Annual Maintenance charge of Rs 1200 for a Startup accounts |

| Commission on Each Transaction | Customized transaction rates available after ₹10 lakh/ month of processed payments | Discounts or cashbacks available eligible payment methods using Razorpay Offers | Available on eligible offers | Available on eligible offers |

| Payment Methods Accepted | Credit/Debit Card, Net banking, UPIs, EMIs, Tez, and E-Wallets | Over 100+ payment modes including Credit/ Debit Cards, 50+ banks, UPIs, Online Wallets, EMIs and NEFT/RTGS payments | NEFT/ RTGS, Debit/ Credit Cards, Netbanking, UPI, EMI, Wallets, Digital products and files | Credit/debit cards, over 35+Indian Net Banks, cash card and mobile payment options |

| Charges on Refunds | Zero with an irrevocable transaction fee | Zero with an irrevocable transaction fee | Zero with an irrevocable transaction fee | Zero with an irrevocable transaction fee |

| What All Stacks Are SDKs Available For? | .NET, ASP.net, Java, PHP, Node.JS, Python Ruby, Android, iOS, Cordova, CSS, HTML, ASP, JSP | cURL, Java, Python, JS, PHP, .Net, Go, Ruby, Node.JS, Android, iOS, React Native, Flutter, Cordova/ Ionic/ PhoneGap | Python, Ruby, PHP, Java, C#, JavaScript, Android, iOS, Ionic | ASP, JSP, PHP, ASP.net, Ruby, Python, Perl, Node.js, Java, Android, iOS |

| Recurring Billing | Supported | Supported | Not Supported | Supported |

| Fraud & Risk Management | PCI-DSS compliant with a 128-bit SSL encryption and other embedded security protocols | PCI-DSS and ISO: 27001 compliant. Also uses tokenization and is 128bit SSL/TLS certified | PCI-DSS compliant with 128-bit AES encryption and Tamper-proof links | PCI-DSS 1.1 Compliant with Verisign’s 128-bit SSL encryption and CCAvenue F.R.I.S. K |

| International Cards Acceptance | Mastercard, Visa, AMEX, Diners, etc. | Mastercard, Visa, AMEX, Diners, etc. | Mastercard, Visa, AMEX, Diners, etc. | Mastercard, Visa, AMEX, Diners, etc. |

| Payouts Support | IMPS, NEFT, UPI, Wallets | IMPS, NEFT, RTGS, UPI, | Bank account used during registration | Bank accounts, NEFT |

| Split Payments | Supported via SplitSttle |

Supported via Razorpay Route | Supported | Supported |

| Settlement Time | 2 working days | 2 working days | 3 working days | 3 working days |

| Onboarding Approvals Time | Instant approval. However, activation depends on documentation verification | Instant approval. However, activation depends on documentation verification | Instant approval; go live in real-time | 24-48hrs |

Comparison Table for PayU, Razorpay, Instamojo, and CCAvenue

Here’s a table summary of PayU vs Razorpay vs Instamojo vs CCAvenue features

Setup Fee

PayU: Zero for PayU merchants

Razorpay: Zero

Instamojo: Zero

CCAvenue: Zero for Startup Pro Plan, Rs. 30,000 for Privilege Plan

Recurring Fee

PayU: 2% + GST per transaction for Indian Credit and Debit Cards, Net banking, Indian Wallets, and UPI

3% + GST fee for international transaction, American Express, Diners Cards, and EMIs plus a setup fee paid along with Annual Maintenance Charges and a service fee of 3% + ₹6 per transaction

Razorpay: 2% fee (GST applicable) per transaction for Indian Consumer Credit Cards, Debit Cards, Net Banking available for 58 Banks, UPI, Wallets

3% fee (GST applicable) per transaction for Amex or Diners Cards, International Cards, EMIs

Instamojo: 2% + Rs. 3 (exclusive GST) per transaction for Indian Debit and Credit Cards, Net banking, UPI, and Indian Wallets

A 3% + Rs. 3 International cards

5% + Rs 3 fee per transaction for free online stores

Rs.7999/year at a 2% + Rs.3 fee per transaction for premium stores

CCAvenue: 2% on Domestic Credit & Debit cards

3.00% on Domestic Commercial Credit Cards

0.00% on UPI Payments and Rupay Debit Cards

4.00% on International Cards

4.99% on 27 Multi-currency options

Annual Maintenance charge of Rs 1200 for a Startup accounts

Commission on Each Transaction

PayU: Customized transaction rates available after ₹10 lakh/ month of processed payments

Razorpay: Discounts or cashbacks available eligible payment methods using Razorpay Offers

Instamojo: Available on eligible offers

CCAvenue: Available on eligible offers

Payment Methods Accepted

PayU: Credit/Debit Card, Net banking, UPIs, EMIs, Tez, and E-Wallets

Razorpay: Over 100+ payment modes including Credit/ Debit Cards, 50+ banks, UPIs, Online Wallets, EMIs and NEFT/RTGS payments

Instamojo: NEFT/ RTGS, Debit/ Credit Cards, Netbanking, UPI, EMI, Wallets, Digital products and files

CCAvenue: Credit/debit cards, over 35+Indian Net Banks, cash card and mobile payment options

Charges on Refunds

PayU: Zero with an irrevocable transaction fee

Razorpay: Zero with an irrevocable transaction fee

Instamojo: Zero with an irrevocable transaction fee

CCAvenue: Zero with an irrevocable transaction fee

What All Stacks Are SDKs Available For?

PayU: .NET, ASP.net, Java, PHP, Node.JS, Python Ruby, Android, iOS, Cordova, CSS, HTML, ASP, JSP

Razorpay: cURL, Java, Python, JS, PHP, .Net, Go, Ruby, Node.JS, Android, iOS, React Native, Flutter, Cordova/ Ionic/ PhoneGap

Instamojo: Python, Ruby, PHP, Java, C#, JavaScript, Android, iOS, Ionic

CCAvenue: ASP, JSP, PHP, ASP.net, Ruby, Python, Perl, Node.js, Java, Android, iOS

Recurring Billing

PayU: Supported

Razorpay: Supported

Instamojo: Not Supported

CCAvenue: Supported

Fraud & Risk Management

PayU: PCI-DSS compliant with a 128-bit SSL encryption and other embedded security protocols

Razorpay: PCI-DSS and ISO: 27001 compliant. Also uses tokenization and is 128bit SSL/TLS certified

Instamojo: PCI-DSS compliant with 128-bit AES encryption and Tamper-proof links

CCAvenue: PCI-DSS 1.1 Compliant with Verisign’s 128-bit SSL encryption and CCAvenue F.R.I.S. K

International Cards Acceptance

PayU: Mastercard, Visa, AMEX, Diners, etc.

Razorpay: Mastercard, Visa, AMEX, Diners, etc.

Instamojo: Mastercard, Visa, AMEX, Diners, etc.

CCAvenue: Mastercard, Visa, AMEX, Diners, etc.

Payouts Support

PayU: IMPS, NEFT, UPI, Wallets

Razorpay: IMPS, NEFT, RTGS, UPI,

Instamojo: Bank account used during registration

CCAvenue: Bank accounts, NEFT

Split Payments

PayU: Supported via

SplitSttle

Razorpay: Supported via Razorpay Route

Instamojo: Supported

CCAvenue: Supported

Settlement Time

PayU: 2 working days

Razorpay: 2 working days

Instamojo: 3 working days

CCAvenue: 3 working days

Onboarding Approvals Time

PayU: Instant approval. However, activation depends on documentation verification

Razorpay: Instant approval. However, activation depends on documentation verification

Instamojo: Instant approval; go live in real-time

CCAvenue: 24-48hrs

Wrapping it up!

The never-ending debate regarding the best payment gateway in the PayU vs. Razorpay vs. Instamojo vs. CCAvenue debate reveals no clear winner. Why? Simply because each payment gateway is designed differently with distinct features and shines in its own right.

Ultimately, the decision comes down to your business structure, expectations, and customer preferences. The triad of payment gateways levels up well against each other with small differences. Razorpay and CCAvenue support most bank and payment options out there, with the former allowing businesses to disburse funds. On the other hand, PayU is excellent for startups, whereas Instamojo is ideal for small businesses.

That said, your best bet lies in consulting experts to get the most relevant insight on which payment gateway would best suit your specific business project.

Are you looking to get your App built? Contact us at hello@devathon.com or visit our website Devathon to find out how we can breathe life into your vision with beautiful designs, quality development, and continuous testing.