Stripe vs Braintree vs 2Checkout Payment Gateways

Spiked by increased digital growth, global online transactions have made quick upward progress. In the process, they have gained many consumers’ deep trust and are bound to increasingly thrive! So much so that there are expected to be over 2 billion digital buyers in the world in 2020. Fast forward, by 2040, around 95% of all purchases are expected to be via e-commerce.

However, you cannot shower online transactions with all the praise without crediting the underlying payment gateways that have become fundamental for their huge success. But what exactly are payment gateways?

What are Payment Gateways?

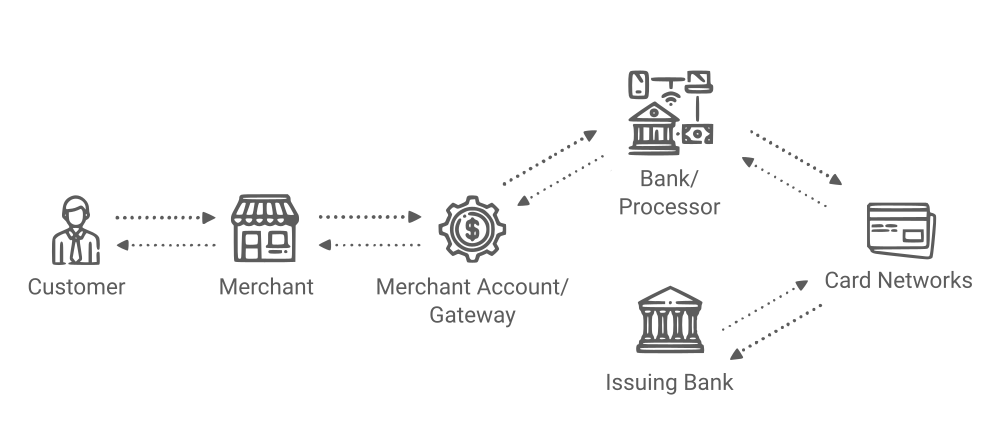

Payment gateways are software that securely authorizes payments from a customers’ bank account to online businesses selling a service. They, therefore, facilitate online transactions between online companies and their customers. Essentially, they act as third-parties between online merchants and their customers by allowing secure online money transfer.

If you do quick research on payment gateways right now, you’ll come across some industry-leading brands, including Stripe, Braintree, and 2Checkout. But which of these should you use to receive and send payments for your business?

Well, fret no more! This article carefully examines the Stripe vs. Braintree vs. 2Checkout showdown and how they level up to each other to help you choose a payment gateway that is better suited for your business.

Stripe vs. Braintree vs. 2Checkout – A General Overview

Before putting the three payment gateways to a head to head comparison, let us first have a glimpse of what they are, and how they function.

Stripe

Founded in 2010, Stripe is a powerful payment processing platform that helps with online money transfers. Stripe allows both individual users and businesses to make online payments using credit or debit card transactions as well as other online payment methods such as Automated Clearing House Network (ACHs) transfers. Stripe is a full-stack payment processor serving both as a payment gateway and a third-party payment processor.

Founded in 2010, Stripe is a powerful payment processing platform that helps with online money transfers. Stripe allows both individual users and businesses to make online payments using credit or debit card transactions as well as other online payment methods such as Automated Clearing House Network (ACHs) transfers. Stripe is a full-stack payment processor serving both as a payment gateway and a third-party payment processor.

Braintree

A subsidiary of PayPal since 2013, Braintree is a payment gateway software that allows for seamless payment transactions through mobile applications and web systems for e-commerce companies.

A subsidiary of PayPal since 2013, Braintree is a payment gateway software that allows for seamless payment transactions through mobile applications and web systems for e-commerce companies.

Aside from providing users with a payment gateway, Braintree also acts as a merchant account, making it a full-stack payments platform. It replaces the standard model of sourcing both payment gateways and merchant accounts from various providers. Moreover, it accepts a variety of payment methods, including credit card, debit card, PayPal, bitcoins, and many more.

2Checkout

Also known as 2CO, 2Checkout is a monetization platform that allows online merchants to receive online payments from their customers locally or internationally. It features an easy-to-use interface and extensive capabilities. 2Checkout also supports diverse currencies and languages to streamline payment processing for buyers and sellers.

Also known as 2CO, 2Checkout is a monetization platform that allows online merchants to receive online payments from their customers locally or internationally. It features an easy-to-use interface and extensive capabilities. 2Checkout also supports diverse currencies and languages to streamline payment processing for buyers and sellers.

Stripe vs Braintree vs 2Checkout – How Do They Work?

Stripe, Braintree, and 2Checkout fundamentally work in the same manner, with only a few differences. It’s a relatively simple concept that begins with users buying service to choosing their preferred payment method and keying in their card details and passwords.

There on, the host website forwards these card details to the customer’s preferred payment gateway. The payment gateway then encrypts the credit card data and forwards it to the customer’s bank’s servers for authorization. The bank will either approve or decline the payment request and after that, send its response back to the payment gateway.

Subsequently, the payment gateway instantly receives and forwards the response to the host website, then to the customer. If the card payment is approved, money is credited to the service provider, meaning that the transaction is successful. If not, the customer receives a message notifying them that their card is declined; hence the transaction is cancelled and unsuccessful.

Subsequently, the payment gateway instantly receives and forwards the response to the host website, then to the customer. If the card payment is approved, money is credited to the service provider, meaning that the transaction is successful. If not, the customer receives a message notifying them that their card is declined; hence the transaction is cancelled and unsuccessful.

Notably, the time taken for the money to reflect in your bank account depends on the payment gateway you have used. Also, Stripe, Braintree, and 2Checkout require users to have an account to make transactions.

Stripe vs Braintree vs 2Checkout – Comprehensive Comparison

Having seen how the payment gateways work, let’s take a closer look at some critical factors to consider when choosing a payment gateway.

In this section, we’ll breakdown the details of Stripe vs. Braintree vs. 2Checkout – comparatively examining what they have to offer your business. Consequently, you should easily identify which payment gateway perfectly suits your business structure. So, without hesitation, let’s get into it:

Pricing

Pricing is one of the critical details any business should look at when choosing a payment gateway. Primarily, the pricing of all three payment gateways is quite similar with a few exceptions as illustrated below:

Stripe

Stripe offers a simple and straightforward pricing scheme. It has no setup or monthly fees. Instead, you only pay when you use the service.

- 2.9% + 30¢ Per successful charge for credit and debit cards

- +1% Additional fees required for international cards and currency conversion

- +1% For instant payouts for eligible debit cards

- 0.8% ACH Processing capped at $5

For more pricing of other details, you may refer to Stripe’s pricing list.

Braintree

Braintree charges users for every processed transaction rather than fixed enterprise pricing packages as follows:

- 2.9% + $0.30 charge per transaction

- An additional 1% fee for transactions presented non-USD currency

- 2.9% + $.30 per transaction across Venmo

- 0.75% per transaction across ACH Direct Debit capped at$5

- Reduced rate of 2.2% + $.30 for eligible nonprofit

- PayPal and PayPal Credit at no additional fee

2Checkout

2Checkout offers three pricing rates based on your plan and successful transactions made. No monthly plans or setup fees are charged.

- 2Sell – 3.5% + 30¢ per transaction

- 2Subscribe – 4.5% + 40¢ per transaction

- 2Monetize – 6.0% + 50¢ per transaction

Chargebacks /Refunds

Common among online payments, chargebacks are charge reversals to the payment card once a customer contacts their bank and disputes a transaction for a variety of reasons such as returns or fraud. Both Stripe and Braintree have a chargeback fee of $15 for each dispute received whereas 2Checkout bases its fee on chargeback ratio. If your chargebacks are less than 1% of your transactions $15 per transaction. Moreover, a 1%-2% ration translates to a $20 fee with a ratio above 2% attracting a $45 fee.

In case a customer gets a refund the trio of payment gateways doesn’t return any processing fees. Importantly, Stripe offers Chargeback Protection to defend businesses from the volatility of disputes at just 0.4% per transaction.

Payment Methods, Plans, and Availability

Stripe is available in 39 countries and continues to explore options for providing the service elsewhere in the world. Stripe accepts Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards as well as Apple Pay, Android Pay, AliPay, Amex Express Checkout, Pay with Google, Bitcoin, and ACH transfers. It also supports over 135 different currencies and offers flexible payment plans to your customers via Stripe Partial.ly business tool.

Braintree currently serves 46 countries and accepts Visa, Mastercard, and American Express as well as JCB, Maestro, Discover, and Diners Club payments. Additionally, Apple Pay, UnionPay, Android Pay, MasterPass, Visa Checkout, Amex Express Checkout, PayPal, Google Pay, ACH transfer, Venmo, and Bitcoin are all supported. You can also accept payments in over 130 currencies. Braintree also offers recurring billing plans that entail flexible pricing and prorated subscriptions for businesses and their customers.

Impressively, 2Checkout is active in over 200+countries and supports over 45 payment methods ranging from typical credit/debit cards, online wallets, and PayPal to regional payment methods. Pay-outs are also available via several methods including wire transfer, PayPal, Payoneer, and ACH in over 130 currencies of your choice. It also offers recurring billing for several payment methods.

Website and eCommerce Integration

Stripe

Stripe is developer-friendly and goes on to provide comprehensive documentation for effortless web integration. Beyond that, it offers web and app developers with API references, Client & Server Libraries, and support sourced from its in-house developers. Its rich UI libraries can be used for both mobile and web frontend development. Stripe also provides community-supported libraries and plugins for CMSs and CRM tools.

Braintree

Braintree delivers straightforward documentation, libraries, and client SDKs software kits for mobile and web platforms to developers. It also provides plugins for CRMs and CMSs websites and is easy to integrate with other APIs and tools. Braintree integration takes less time but it may vary depending on your business needs.

2Checkout

2Checkout can be easily integrated to websites courtesy of its provided code and API libraries. Furthermore, its website is easy to navigate and features customizable and well-maintained developer tools. 2Checkout can be easily integrated with CRM and CMSs tools and on online retail platforms.

Security

Customer data security and privacy are a sensitive subject for business, and you ideally want a payment gateway that securely handles payment processing data for you. That said, Stripe, Braintree, and 2Checkout services are Payment Card Industry (PCI) Compliant meaning that they adhere to the strict standards set by the PCI guidelines. Besides, they all have well-secured sites, sandboxes, and protocols put in place to mitigate data breaches for cardholders. All of them have got your security concerns covered!

Customer support

Customer support is critical when choosing the best payment gateway, given the degree of funds and other factors involved. Unfortunately, Stripe partially lags on customer service. Many users have continuously ranted about their unresponsiveness when reporting long payout times, unexplained charges, and frozen funds. On their part, Stripe has gradually improved to rectify this issue and, in the process, provided phone support unlike before.

On the other hand, both Braintree and 2Checkout have posted better customer service reviews and seem to respond to inquiries and emails promptly. Better yet, they have contact numbers for support for payment related issues.

User-friendliness

When selecting a payment gateway, user-friendliness instantly comes to mind. As seen above, all gateways are developer-friendly with Braintree having a slight edge. But how do they fair to customers?

Braintree is more user-friendly compared to Stripe and 2Checkout with simple transaction processes. Meanwhile, Braintree and 2Checkout easily beat Stripe, with the latter particularly shining by supporting many payment options, available countries, and currencies. This means that customers have diverse options and currencies to make payments.

2Checkout and Stripe are also available in more localized languages compared to Braintree.

Which Businesses Use These Payment Gateways

Stripe fits both startups and large corporations and is used by companies such as Slack, Dribble, Lyft, Splunk, Google Amazon, Foursquare to power payments.

Braintree boasts a vast customer base, including GitHub, Uber, Airbnb, Dropbox, and many more.

Braintree boasts a vast customer base, including GitHub, Uber, Airbnb, Dropbox, and many more.

2Checkout facilitates payments for some well-known brands, including Hp, Kaspersky, IObit, Malwarebytes, to name a few.

2Checkout facilitates payments for some well-known brands, including Hp, Kaspersky, IObit, Malwarebytes, to name a few.

Consequently, the business partnerships above prove that Stripe, Braintree, and 2Checkout are trusted payment gateways that are substantially powering payments for some of the world’s biggest brands.

Consequently, the business partnerships above prove that Stripe, Braintree, and 2Checkout are trusted payment gateways that are substantially powering payments for some of the world’s biggest brands.

Comparison Table for Stripe, Braintree, and 2Checkout

Here’s a table summary of Stripe vs Braintree vs 2Checkout features

| Feature | Stripe | Braintree | 2Checkout |

| Setup Fee | No setup or monthly fees | No setup or monthly fees | No setup or monthly fees |

| Recurring Fee | 2.9% per transaction plus $0.30 | 2.9% per transaction plus $0.30 | Based on your pan as follows: 2Sell – 3.5% + $0.35 per transaction 2Subscribe – 4.5% + $0.45 per transaction 2Monetize – 6.0% + $0.60 per transaction |

| Commission on Each Transaction | Discounts for eligible large-volume clients and non-profits | Available during promotions or price breaks | Available on assigned products |

| Payment Methods Accepted | Supports Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards as well as Apple Pay, Android Pay, AliPay, Amex Express Checkout, Pay with Google, Bitcoin, and ACH transfer | Supports PayPal, Google Pay, Apple Pay, Venmo, and most credit and debit cards, including Visa, Mastercard, American Express, JCB, Discover, and Diner’s Club. | Supports over 45 payment methods including Visa, Visa Electron, Mastercard, Maestro, Eurocard, American Express, JCB, PayPal, Apple Pay, etc. |

| Charges on Refunds | $15 fee | $15 fee | Dependent on your business’s chargeback ratio. If your chargebacks are less than 1% of your transactions the chargeback fee is $15 per transaction. If between 1%-2% a $20 fee is charged, and if higher than 2% the fee is $45. |

| What all stacks are SDKs available for? | Ruby, Python, PHP, C#, Java, iOS and Android | HTML + JS, React, Ruby, Python, PHP, Java, Node, Go, Kotlin, .NET, iOS and Android | Ruby, PHP, Node, Java, .NET, Python, iOS, and Android |

| Recurring billing | Available | Available | Available |

| Fraud & Risk Management | Level 1 PCI Compliant, PGP encryption, etc. | Level 1 PCI compliant, data encryption, activity monitoring, and testing. | PCI Level 1 certified as well as a three-tier defense plan to detect fraud in real-time. |

| International Cards Acceptance | Supports Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards. | Visa, Mastercard, American Express, JCB, Discover, and Diner’s Club among others. | Visa, Mastercard, Maestro, Eurocard, American Express, JCB, and many more. |

| Payouts Support | Manual or Automated payouts to bank accounts. | Direct bank deposit, prepaid card, PayPal, Hyperwallet, and more. | Wire transfer, Payoneer, and PayPal. |

| Split Payments | Supported via Connect | Supported via Marketplace | Supported |

| Settlement Time | 2-day payouts to most US or Australia based merchants except those deemed high-risk. Other International merchants may wait longer depending on their country. Instant payouts allowed for supported debit cards. |

2 – 5 Business days | Payouts occur on a weekly basis 2Sell and 2Subscribe plans. 2Monetize offers monthly payouts.

However, payouts are negotiable subject to 2Checkout Finance approval. |

| Onboarding & Approvals Time | Immediate approval for some merchants. In cases where additional information is needed, within one business day. | Instant approval for some merchants with delays expected if more information is required. | 5 – 7 Business days |

Comparison Table for Stripe, Braintree and 2Checkout

Here’s a table summary of Stripe vs Braintree vs 2Checkout features

Setup Fee

Stripe: No setup or monthly fees

Braintree: No setup or monthly fees

2Checkout: No setup or monthly fees

Recurring Fee

Stripe: 2.9% per transaction plus $0.30

Braintree: 2.9% per transaction plus $0.30

2Checkout:

Based on your pan as follows:

2Sell – 3.5% + $0.35 per transaction

2Subscribe – 4.5% + $0.45 per transaction

2Monetize – 6.0% + $0.60 per transaction

Commission on Each Transaction

Stripe: Discounts for eligible large-volume clients and non-profits

Braintree: Available during promotions or price breaks

2Checkout: Available on assigned products

Payment Methods Accepted

Stripe: Supports Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards as well as Apple Pay, Android Pay, AliPay, Amex Express Checkout, Pay with Google, Bitcoin, and ACH transfer

Braintree: Supports PayPal, Google Pay, Apple Pay, Venmo, and most credit and debit cards, including Visa, Mastercard, American Express, JCB, Discover, and Diner’s Club.

2Checkout: Supports over 45 payment methods including Visa, Visa Electron, Mastercard, Maestro, Eurocard, American Express, JCB, PayPal, Apple Pay, etc.

Charges on Refunds

Stripe: $15 fee

Braintree: $15 fee

2Checkout: Dependent on your business’s chargeback ratio. If your chargebacks are less than 1% of your transactions the chargeback fee is $15 per transaction. If between 1%-2% a $20 fee is charged, and if higher than 2% the fee is $45.

What All Stacks Are SDKs Available For?

Stripe: Ruby, Python, PHP, C#, Java, iOS and Android

Braintree: HTML + JS, React, Ruby, Python, PHP, Java, Node, Go, Kotlin, .NET, iOS and Android

2Checkout: Ruby, PHP, Node, Java, .NET, Python, iOS, and Android

Recurring Billing

Stripe: Available

Braintree: Available

2Checkout: Available

Fraud & Risk Management

Stripe: Level 1 PCI Compliant, PGP encryption, etc.

Braintree: Level 1 PCI compliant, data encryption, activity monitoring, and testing.

2Checkout: PCI Level 1 certified as well as a three-tier defence plan to detect fraud in real-time.

International Cards Acceptance

Stripe: Supports Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards.

Braintree: Visa, Mastercard, American Express, JCB, Discover, and Diner’s Club among others.

2Checkout: Visa, Mastercard, Maestro, Eurocard, American Express, JCB, and many more.

Payouts Support

Stripe: Manual or Automated payouts to bank accounts.

Braintree: Direct bank deposit, prepaid card, PayPal, Hyperwallet, and more.

2Checkout: Wire transfer, Payoneer, and PayPal.

Split Payments

Stripe: Supported via Connect

Braintree: Supported via Marketplace

2Checkout: Supported

Settlement Time

Stripe:

2-day payouts to most US or Australia based merchants except those deemed high-risk. Other International merchants may wait longer depending on their country.

Instant payouts allowed for supported debit cards.

Braintree: 2 – 5 Business days

2Checkout:

Payouts occur on a weekly basis 2Sell and 2Subscribe plans. 2Monetize offers monthly payouts.

However, payouts are negotiable subject to 2Checkout Finance approval.

Onboarding Approvals Time

Stripe: Immediate approval for some merchants. In cases where additional information is needed, within one business day.

Braintree: Instant approval for some merchants with delays expected if more information is required.

2Checkout: 5 – 7 Business days

Conclusion – Which Payment Gateway Should you Choose?

In the comparison of Stripe vs. Braintree vs. 2Checkout, it’s clear that each payment gateway excels in its own right. Stripe shines in innovation and features, whereas Braintree offers stability, swiftness, and user-friendliness. Alternatively, 2checkout offers versatility as well as comprehensive features.

When making a decision on which payment gateway to choose, be guided by the business model with regard to your business processes and customer requirements.

Are you looking to get your App built? Contact us at hello@devathon.com or visit our website Devathon to find out how we can breathe life into your vision with beautiful designs, quality development, and continuous testing.