PayPal vs. Stripe vs. Square

Online payment gateways have arguably become one of the most dynamic disruptions in the financial industry. They are also fast-evolving, driven by increased customer trends online and successful companies have adjusted to leading payment gateways to remain competitive. So fast that projections into their future show that global e-retail sales will grow to up to $4.8 trillion by 2021.

When researching the best payment gateways for your business, you’ll come across PayPal, Stripe, and Square — the top players in the game. But despite their role in facilitating secure online transactions between businesses and customers, PayPal, Stripe, and Square are radically different in several key areas. What features make them different from each other and which one is better?

In this guide, we compare PayPal, Stripe, and Square on some of the most important criteria to help you stay abreast of the industry and know which payment gateway better matches your customer and business needs!

PayPal, Stripe, and Square – A Quick Overview

For some groundwork, here’s a brief overview of each payment gateway

PayPal Overview

As far as history goes, PayPal is a digital payment service that allows users to send and request money online. The gateway prides itself on being one of the pioneers in online transactions and has a vast global presence.

PayPal also offers peer-to-peer transactions to its users, a service that other payment gateways may not provide. Businesses that use PayPal include eBay, Expedia, Pandora, and many more.

Stripe Overview

Stripe is a powerful payment API that helps its users move money online. It allows individuals and companies to make online payments using credit cards and other primary online payment methods. Stripe can be used both as a payment gateway and a payment processor. Stripe is used by Amazon, Shopify, Foursquare, Dribble, Google, Slack, and other companies.

Stripe is a powerful payment API that helps its users move money online. It allows individuals and companies to make online payments using credit cards and other primary online payment methods. Stripe can be used both as a payment gateway and a payment processor. Stripe is used by Amazon, Shopify, Foursquare, Dribble, Google, Slack, and other companies.

Square Overview

Lastly, we have Square, which is a merchant services and mobile payment platform. Square offers a suite of business software such as Square Cash, payment hardware, and other small business services. Its main highlight is its free Point-of-Sale (POS) system, a mobile application that lets businesses process payments via smartphone. Companies that use Square include Fuzz, Acuity Scheduling, La Colombe Coffee Roasters, etc.

Lastly, we have Square, which is a merchant services and mobile payment platform. Square offers a suite of business software such as Square Cash, payment hardware, and other small business services. Its main highlight is its free Point-of-Sale (POS) system, a mobile application that lets businesses process payments via smartphone. Companies that use Square include Fuzz, Acuity Scheduling, La Colombe Coffee Roasters, etc.

PayPal vs. Stripe vs. Square: How They Work

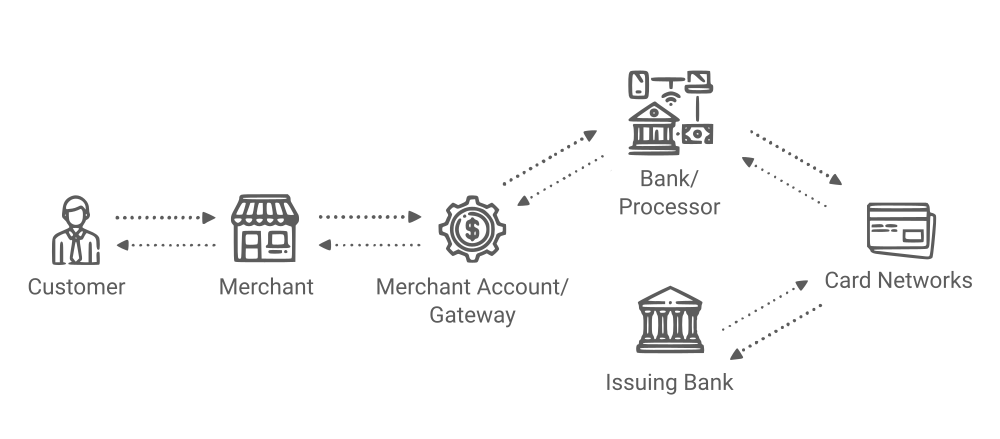

All these payment gateways, PayPal, Stripe, and Square work by establishing a secure connection between consumers, their bank or money service provider, and an online business platform. It means that they can process and authorize electronic or digital payments in real-time as detailed below:

To purchase a service or product, customers choose their preferred payment method and enter their details on the host website. The website then sends these details to the customer’s payment gateway selected, either PayPal, Stripe, or Square.

The payment gateway encrypts the customer’s credit card data and sends it to the client’s bank or financial service provider for processing and authorization. After that, one of two things happen, the bank either approves or declines the request and immediately sends a response back to the payment gateway.

The payment gateway encrypts the customer’s credit card data and sends it to the client’s bank or financial service provider for processing and authorization. After that, one of two things happen, the bank either approves or declines the request and immediately sends a response back to the payment gateway.

Consequently, the payment gateway instantly sends the response to both the website and customer. If the payment is approved, the funds are credited to the business account. If not, the customer is informed that their payment was declined, in which case the transaction is cancelled.

Paypal vs. Stripe vs. Square: Feature Comparison

Now let’s move towards a detailed comparison of PayPal, Stripe, and Square. We’ll look at important factors to consider when choosing between these three payment gateways.

Pricing/Cost

One vital feature that businesses need to get right when settling on a payment gateway of course, is the pricing criteria. That said, neither PayPal, Stripe nor Square charge setup or subscription fees. Instead, they charge for every successful transaction, as shown below:

PayPal

Here are the PayPal charges:

- Online Transactions at 2.9% + $0.30 (within the USA)

- Online Invoices at 2.9% + $0.30

- PayPal Here Transactions at 2.7%

- Keyed Entry Transactions at 3.5% + $0.15

- Micropayments options for low-value transactions at 5% + $0.05

- Nonprofit Discount Rate at 2.2% + $0.30

High-volume merchants are also eligible for special rates if they use PayPal’s partners, such as Braintree, Vend, etc. International business charges are a minimum of 3.5% as an exchange fee between the US and Canada, and a minimum of 4% for other countries.

Stripe

Here’s what you pay for Stripe Services:

- 2.9% + 30¢ for online credit and debit cards transactions

- +1% Additional fees for international cards and currency conversion

- +1% for instant payouts for eligible debit cards

- 0.8% ACH Transactions capped at $5

- 3.9% for international sales

Square

Here’s what you pay for Square:

- 2.6% + 10¢ for online payments

- 3.5% + 15¢ for keyed transactions, Square Virtual Terminal and Card on file transactions

- 2.9% + 30¢ for Invoices, APIs and In-app payments

Chargebacks/Refunds

Chargebacks can be hurtful for businesses, so it is essential to have a clear perspective of how they’re handled.

Apart from the transaction fee which isn’t returned, PayPal charges a $20.00 fee, which is refundable if a case is ruled in your favor. Stripe, on the other hand, issues a refundable $15.00 fee for such instances. And, more impressively, Stripe provides credit card fraud protection in their Stripe Radar feature package. Square doesn’t charge any additional fees for chargebacks.

Payment Methods, Plans, and Availability

Away from transaction fees and refunds, this is another point for consideration when comparing PayPal, Stripe, and Square as it can help increase your business’s conversion rate.

For one, PayPal supports 25 currencies and is available in more than 200 countries around the world, which gives businesses the potential to reach many customers. Payments are made using various methods, including PayPal Cash, PayPal Cash Plus, bank accounts, and rewards balance. It also accepts payments from every major debit, credit card, and the compelling PayPal Credit. PayPal Credit extends credit to your customers subject to approval.

On its part, Stripe is only available in 39 countries and growing but supports over 135 different currencies while accepting far more payment methods. Stripe accepts major cards including Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards. Supported wallets include Apple Pay, Android Pay, Alipay, Amex Express, Visa Checkout, Google Pay, Bitcoin, WeChat pay, etc. Stripe also supports ACH transfers, which PayPal doesn’t. It provides flexible payment plans to your customers via the Stripe Partial.ly business tool.

For Square, its services are only available in the USA, UK, Japan, and Australia. Unfortunately, Square doesn’t offer different currencies, as it is determined by where the account is set up. Square accepts payments with any US-issued and most internationally-issued chip or magstripe cards bearing Visa, MasterCard, American Express, Discover, JCB, or UnionPay logos. Credit, Corporate, Debit, Prepaid, and Reward card types, as well as Electronic Invoices and Pay with Square, are all accepted. Square PoS app processes all card types, whereas Square Terminal accepts Apple Pay, Google Pay, and NFC.

Security

Ideally, you need a payment gateway that offers excellent security tools for both your business and customers. The good news is that PayPal, Stripe, and Square are robust, stable, and secure payment platforms. They do not only use end-to-end encryption to store data securely but are PCI Compliant. Besides, each company employs other internal security, privacy, and fraud protection practices to ensure sensitive data is protected from unauthorized access. With this in mind, you can be confident of data being handled securely.

Website and Ecommerce Integration

With PayPal, you can access integrations for Google, WordPress, Shopify eBay, and many others. It’s pretty easy for web and app developers to integrate and set up given its detailed guides, references, plugins, tools, and a vast developer community to offer assistance.

Stripe’s selling point is its developer-friendliness, meaning that it is designed with developers in mind. It has extensive documentation, references, developer tools, extension, and plugins. Moreover, there are developers ready to assist you in the integration process. It also allows developers to achieve many customizations compared to Square and PayPal.

Square has mostly made businesses in need of a POS system by providing the opportunity to sell items online. It takes a simple online approach that does not have the customization abilities that PayPal and Stripe have for a developer. It provides tools, interactive APIs, a developer dashboard, and documentation, but not many plugins like its counterparts.

User-friendliness

PayPal, Stripe, and Square are designed for simplicity, making it very easy for customers to pay businesses. Nonetheless, companies may have different experiences.

For one, PayPal is incredibly easy to set up, integrate, and start taking payments even for people without developer skills. If you can read HTML while being able to copy and paste the developer tools, setting up PayPal is straightforward.

For Stripe, its developer-friendly API is a unique selling point. However, the feature often appeals coming from a developer viewpoint. As such, even with its comprehensive developer tools and libraries, people lacking developer skills will find it challenging to set up and integrate Stripe.

Square, just like PayPal, makes it easy for almost anyone to integrate its payment processing into your business software with its APIs. It also includes resources to guide you through the process.

Customer Support

In the customer department, it’s fair to say PayPal, Stripe, and Square are evenly matched and aren’t known for having excellent customer support. Nevertheless, they offer different customer service and support options, including Phone & Email Support, Live chat support, Developer Support, Social media, and Community forums, to mention a few.

Timely Access to Funds

Whichever payment you choose, it’s imperative to have quick and smooth access to your funds. PayPal’s payout time takes between 2 to 3 days with an instant transfer option charged at a 1% fee of the transfer. Stripe’s standard payout time lies within two business days. Other regions may experience different payout time. Instant payouts are also available at a charge. Square has funds that reflect your bank account within 1-2 business days, depending on when it is processed. You’ll also get same-day transfers and instant transfers for a 1.5% fee per transfer.

Remember, payout times may change in case of any disputes or other relevant challenges.

PayPal vs. Stripe vs. Square – Which is Right for Your Business?

You might wonder which option to pick when it comes to PayPal, Stripe, and Square? To put it simply, that depends on your business needs. Generally, PayPal is suitable for businesses that want an easy setup for online payments.

If you’re a startup or high-tech business-to-consumer eCommerce business, Stripe is the way to go.

Meanwhile, Square remains the to-go option for retail/brick-and-mortar businesses as it offers in-person payments and an offline presence.

Comparison Table for PayPal, Stripe, and Square

Here’s a table summary of PayPal vs Stripe vs Square

| Feature | PayPal | Stripe | Square |

| Setup Fee | No setup or monthly fees for the basic plan | No setup or monthly fees | No setup or monthly fees |

| Recurring Fee | 2.9% + 30¢ per transaction | 2.9% + 30¢ per transaction | 2.9% + 10¢ per transaction |

| Commission on Each Transaction | Discounts for high-volume merchants who use PayPal’s partners, such as Braintree. | Discounts for eligible large-volume clients and non-profits. | Available on assigned products. |

| Payment Methods Accepted | Major Credit and debit cards, Checks, Electronic Invoices, PIN debit, PayPal | Visa, Mastercard, American Express, JCB, Maestro, Discover, Diners Club cards, Apple Pay, Android Pay, Alipay, Amex Express Checkout, Pay with Google, Bitcoin, and ACH transfer | Major Credit and debit cards Electronic Invoices, Pay with Square, Reward cards, and Apple Pay, Google Pay, and NFC via Square Terminal |

| Charges on Refunds | $20 fee | $15 fee | None |

| What all stacks are SDKs available for? | Java, .NET, Node, PHP, Python, Ruby, iOS, Android | Ruby, Python, PHP, C#, Java, iOS and Android | PHP, Ruby, Java, .Net, Python, Node, iOS, Android, React Native, Flutter |

| Recurring Billing | Available | Available | Available |

| Fraud & Risk Management | Provides end-to-end encryption, PCI compliance, fraud and chargeback prevention practices, etc. | Provides end-to-end encryption, PCI compliance, fraud and chargeback prevention practices, etc. | Provides end-to-end encryption, PCI compliance, fraud and chargeback prevention practices, etc. |

| International Cards Acceptance | Major credit and debit cards, including Visa, MasterCard, Amex, Discover, etc. | Supports Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards | Visa, MasterCard, American Express, Discover, JCB, or UnionPay |

| Payouts Support | PayPal Cash or PayPal Cash Plus account balance, bank accounts, PayPal Credit, debit or credit cards, and rewards balance | Manual or Automated payouts to bank accounts | Square Card and linked bank accounts |

| Split Payments | Supported via PayPal Bill Split | Supported via Connect | Supported via Split Tender |

| Settlement Time | 2 – 3 days with an instant transfer option charged at 1% of the transfer | 2-day payouts for the US or Australia. Payouts for International merchants may vary

Instant payouts allowed for supported debit cards |

1-2 business days with same-day or instant transfers available for a 1.5% fee per transfer |

| Onboarding & Approvals Time | Instant approval. However, in cases where additional information is needed, it may take longer | Immediate approval for some merchants. In cases where additional information is needed, within one business day | Instant approval with 1-3 business days required for some cases |

Comparison Table for PayPal, Stripe and Square

Here’s a table summary of PayPal vs Stripe vs Square features

Setup Fee

PayPal: No setup or monthly fees for the basic plan

Stripe: No setup or monthly fees

Square: No setup or monthly fees

Recurring Fee

PayPal: 2.9% + 30¢ per transaction

Stripe: 2.9% + 30¢ per transaction

Square: 2.9% + 10¢ per transaction

Commission on Each Transaction

PayPal: Discounts for high-volume merchants who use PayPal’s partners, such as Braintree.

Stripe: Discounts for eligible large-volume clients and non-profits.

Square: Available on assigned products.

Payment Methods Accepted

PayPal: Major Credit and debit cards, Checks, Electronic Invoices, PIN debit, PayPal

Stripe: Visa, Mastercard, American Express, JCB, Maestro, Discover, Diners Club cards, Apple Pay, Android Pay, Alipay, Amex Express Checkout, Pay with Google, Bitcoin, and ACH transfer

Square:

Major Credit and debit cards

Electronic Invoices, Pay with Square, Reward cards, and Apple Pay, Google Pay, and NFC via Square Terminal

Charges on Refunds

PayPal: $20 fee

Stripe: $15 fee

Square: None

What All Stacks Are SDKs Available For?

PayPal: Java, .NET, Node, PHP, Python, Ruby, iOS, Android

Stripe: Ruby, Python, PHP, C#, Java, iOS and Android

Square: PHP, Ruby, Java, .Net, Python, Node, iOS, Android, React Native, Flutter

Recurring Billing

PayPal: Available

Stripe: Available

Square: Available

Fraud & Risk Management

PayPal: Provides end-to-end encryption, PCI compliance, fraud and chargeback prevention practices, etc.

Stripe: Provides end-to-end encryption, PCI compliance, fraud and chargeback prevention practices, etc.

Square: Provides end-to-end encryption, PCI compliance, fraud and chargeback prevention practices, etc.

International Cards Acceptance

PayPal: Major credit and debit cards, including Visa, MasterCard, Amex, Discover, etc.

Stripe: Supports Visa, Mastercard, American Express, JCB, Maestro, Discover, and Diners Club cards

Square: Visa, MasterCard, American Express, Discover, JCB, or UnionPay

Payouts Support

PayPal: PayPal Cash or PayPal Cash Plus account balance, bank accounts, PayPal Credit, debit or credit cards, and rewards balance

Stripe: Manual or Automated payouts to bank accounts

Square: Square Card and linked bank accounts

Split Payments

PayPal: Supported via PayPal Bill Split

Stripe: Supported via Connect

Square: Supported via Split Tender

Settlement Time

PayPal: 2 – 3 days with an instant transfer option charged at 1% of the transfer

Stripe:

2-day payouts for the US or Australia. Payouts for International merchants may vary

Instant payouts allowed for supported debit cards

Square: 1-2 business days with same-day or instant transfers available for a 1.5% fee per transfer

Onboarding Approvals Time

PayPal: Instant approval. However, in cases where additional information is needed, it may take longer

Stripe: Immediate approval for some merchants. In cases where additional information is needed, within one business day

Square: Instant approval with 1-3 business days required for some cases

Conclusion

For businesses, payment gateways save time, offer convenience, provide a vast customer base, and eliminate data security worry. They also provide smooth, quick, secure, and diverse online transactions for both individuals and business.

However, every business has a unique business model and customer base. With so much disparity between companies, it’s utterly impossible to reach a verdict that either PayPal, Stripe, or Square is better than the other. They may serve very different functions but are the best in what they do.

With the detailed comparison between PayPal, Square and Stripe discussed above, you now have better insights into how each of them operates, and we trust that you’re better equipped to make an intelligent choice. If you are still confused about which payment gateway to integrate into your business, you can consult with our experts to guide you through the process. Good luck!

Are you looking to get your App built? Contact us at hello@devathon.com or visit our website Devathon to find out how we can breathe life into your vision with beautiful designs, quality development, and continuous testing.